To learn more about this process, check out our article on how to record the journal entry for disposal of fixed assets. This is the amount of the cost of an asset that is allocated and reported at the end of each reporting period. It is calculated by subtracting the value an asset is likely to retain when totally depleted from the value of the asset at time of acquisition, and then dividing the result by the asset life span. It is reported in the income statement, and is useful for taxation purposes, as it decreases the taxable income in a business. This account, known as Accumulated Depreciation, is a critical component of a company’s financial statements.

Calculation of Depreciation Expense

To see how the calculations work, let’s use the earlier example of the company that buys equipment for $25,000, sets the salvage value at $2,000 and the useful life at five years. The accumulated depreciation for the asset would be $4,600 for the first year and grow by another $4,600 in each subsequent year. The term amortization is used in both accounting and lending with different definitions and uses.

Asset Cost Basis

As a result, it will bring the van’s book value down to its salvage value of $5,000. Assume a business spends $50,000 on equipment that has $5,000 in salvage value after ten years. In this case, you can observe that the straight-line rate is 10% (100% ÷ 10 years). Depreciation is $9,000 (45,000 x 20%) in the initial year of operation. In the following year, the depreciation is recorded as $7,200 (($45,000 – $9,000) x 20%). On a balance sheet, you can see it reduce the value of the related asset.

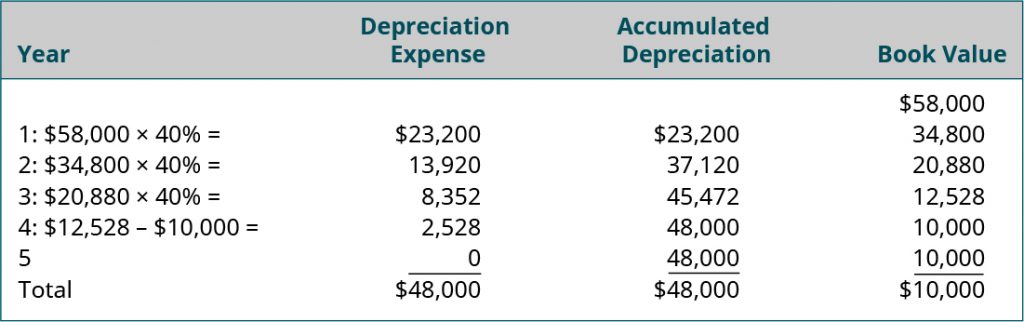

Double-Declining Balance (DDB)

- The cost of the building minus its resale value is spread out over the predicted life of the building with a portion of the cost being expensed in each accounting year.

- For accounting purposes, the depreciation expense is debited, while the accumulated depreciation is credited.

- Assuming the retailer uses the straight-line depreciation method, during each month of the display racks’ lives the retailer’s monthly income statement will report depreciation expense of $1,000.

- Accumulated depreciation can be reversed through depreciation reversal, typically resulting from asset revaluation, which reassesses the asset’s value.

There are several different depreciation methods, including straight-line depreciation and accelerated depreciation. Depreciation is an accounting practice used to spread the cost of a tangible or physical asset, such as a piece of machinery or a fleet of cars, over its useful life. The amount an asset is depreciated in a given period of time is a representation of how much of that asset’s value has been used up. Calculating accumulated depreciation is a simple matter of running the depreciation calculation for a fixed asset from its acquisition date to the current date.

Capitalization, which is used to reflect the long-term value of an asset, is the process of recording an expense as an asset on the balance sheet versus as an expense on the income statement. Despite the differences between amortization and depreciation, on the income statement, both techniques are recorded as expenses. The straight-line method is the most basic way to record depreciation. It reports an equal depreciation expense each year throughout the entire useful life of the asset until the asset is depreciated down to its salvage value. Under MACRS, the IRS assigns a useful life to different types of assets.

For example, if an asset has a five-year usable life and you purchase it on January 1st, then 100 percent of the asset’s annual depreciation can be reported in year one. However, if you buy the same asset on July 1st, only 50 percent of its value can be depreciated in year one (since you owned it for half the year). Proration reduces the depreciation that you can claim in a given year. Proration considers the accounting period that an asset had depreciated over based on when you bought the asset.

Depreciation expense is consistently reported on a company’s income statement, serving as a vital non-cash charge that accounts for the systematic allocation of asset costs over their useful lives. This expense is essential for businesses to match the cost of assets with the revenue difference between accumulated depreciation and depreciation expense they generate. Accumulated depreciation, in simple words, is an accounting term that indicates the total depreciation expense amount which is recorded against a fixed asset. When defined in another way, it simply reflects an asset’s value that has been used up over a time period.

Almost all intangible assets are amortized over their useful life using the straight-line method. When you record depreciation on a tangible asset, you debit depreciation expense and credit accumulated depreciation for the same amount. This shows the asset’s net book value on the balance sheet and allows you to see how much of an asset has been written off and get an idea of its remaining useful life. Assets often lose a more significant proportion of its value in the early years of its service than in its later life.