Also, if you pay independent contractors $600 or more during the year, you’ll need to send each one a 1099-NEC form, as well as copies to the IRS. The deadline for sending these forms to employees and contractors is January 31. If you have to sell inventory for a deep discount, you could deduct it from your year-end taxes.

- The importance of accounting for small businesses can’t be underestimated.

- Before you open a bank account, make sure to do some research about all of the different options.

- This can be as simple as a statement showing your current cash position, expected upcoming cash receipts, and expected cash payments for this period.

- If you have to sell inventory for a deep discount, you could deduct it from your year-end taxes.

QuickBooks

Funnily enough, though, a lot of business owners think that using a checkbook is still an efficient way to manage their company’s accounting in 2021. And similarly to the cash flow statement, most small businesses won’t ever need to use a statement of retained earnings. Large publicly traded corporations generally rely on this financial statement to decide on things like dividends disbursements, company valuation, etc. Even if you decide to hire a bookkeeper or a freelance accountant in the near future, it’s useful to know at least the essentials of accounting. Remember that if you have employees, you’ll also need to account for payroll tax. If you’re unsure about your tax obligations, you may want to talk to a professional accountant or tax expert for advice.

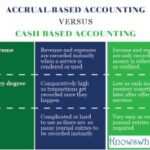

Having a business bank account makes it much easier to file business taxes, it keeps business income separate from your personal funds, and it provides you with a way to pay your vendors. While most larger businesses have an accounting staff that takes care of financial transactions, as a small business owner, the job of accountant typically falls to you. For business owners without a break-even price definition bookkeeping or accounting background, the prospect can be overwhelming. If you set up your finances with accrual-basis accounting, you’ll record financial transactions when they occur, not when the money moves accounts.

QuickBooks Online users can choose QuickBooks Live Bookkeeping to get year-round access to verified experts who are focused on their success. From the start, business owners can get personalized answers to questions and spend less time on their books. After you have a bookkeeping system in mind, the next step is to pick an accounting software. Spreadsheets, such as Microsoft Excel, can be used for simple bookkeeping.

Review cash flow

There are basically two methods of recording income and what are accrued liabilities expenses – the cash basis and the accrual basis of accounting. Using accounting software can allow you to save time when managing the books for your business. You can sync financial accounts to easily import transaction history, track expenses, double-check transactions for accuracy, and generate important financial statements. Implementing systems and best practices for keeping track of expenditures and revenues is key to managing cash flow.

Closing Entries

The majority of your financial transactions will have to do with income and expenses. Knowing how to handle these two items will ensure that your business runs smoothly. Even if you’re a sole proprietor, it’s a good idea to open a business bank account. Using spreadsheet software is the cheapest accounting option (especially if you use a completely free software, like Google Sheets). Start by learning all about how to open a business bank account, then check out our top recs for business checking and business savings accounts to find the right account for you. Accounts receivable (AR) is the money your customers owe you for products or services they bought but have not yet paid for.

On top of doing the work, stay updated on the constantly evolving financial trends and laws that will affect your business. You can check authorized, government websites like the IRS for this information. Some CPAs and bookkeepers require a retainer if you want monthly assistance, but many simply charge by the hour. Then categorize your expenses into different categories, start estimating your expected revenue for the upcoming period, and allocate your expenses accordingly.

You can use an accounts receivable aging report for a quick view of outstanding customer payments. The beginning of the month is a good time to send overdue reminder statements to customers, clients, and anyone else who owes you money. Under the cash-basis method of accounting, you record income and expenses when cash transactions are done.

The second you decide you’re going to launch your business, you should immediately separate your personal finances from your business finances. That means setting up a separate business bank account to handle all your small-business transactions, including a business savings account to cover your business on a rainy day. The financial statements which include the income statement, statement of changes in equity, balance sheet, statement of cash flow and notes are the end products of the accounting system.

Instead, an account is a record of all financial transactions for a certain type. There are three financial statements that all small businesses should consider creating. GnuCash is a single-user system, so you won’t be able to network the product to accommodate additional users. But if you plan on being the only user, you can download this small business accounting application anytime at no cost. If you’re comparing deferred expenses vs prepaid expenses using accounting software, the accounting cycle is automated, reducing the number of steps drastically.